More and more people are falling victim to identity theft today. This concept covers any kind of crime, scam, or form of deception leading to loss of Social Security numbers, usernames, passwords, credit card numbers, banking data, health-related data, or any other type of personal data, which is then used to commit crimes like a fraud without your knowledge – and without your permission, obviously.

The repercussions of identity theft can vary from a slight inconvenience to extensive damages, including financial and emotional ones. Some people are able to resolve their issues quickly. Others can lose thousands of dollars, have their loan applications rejected, suffer a painful loss of face, lose job opportunities, or suffer other disastrous consequences.

Ways of Stealing an Identity

Before getting into the ways to secure your identity online, let’s look at how identity theft is typically committed. While old-fashioned ways like stealing mail, purses, and wallets or making copies of your credit card or utility bills still apply, online identity theft has become far more common.

This happens when internet users fall for things like phishing scams, use unsecured wireless networks, download viruses or other malware onto their phones, computers, or other devices that steal their data, or share their login details with fraudsters inadvertently.

Withdrawing cash from an ATM with a skimming device or losing data in a breach on a government, educational, or company website are also common ways to suffer identity theft. Here are 5 ways to make yourself immune.

1. Monitor Your Credit

When someone steals your identity, your credit will probably be hit. This is why monitoring your credit scores is of paramount importance. Equifax, Experian, and Transunion make one free credit report available every year.

In other words, you can get three credit reports a year for free. You can request yours from AnnualCreditReport.com, through which the three bureaus work. This is a completely safe site that will show you your credit report at once.

Alternatively, you can request your copies by phone. The toll-free number is (877) 322-8228. After undergoing a brief verification, your reports will be mailed to you. Of course, you can also request them by mail.

To get another free copy, you need to wait one year. You can get one in exchange for payment at any time. The main part of monitoring your credit is reviewing your score. When you check your report, watch for new loans, credit lines, or other products that don’t seem familiar. If there are, have them investigated and closed as soon as possible.

Your credit can be one of the first things to plummet if you fall victim to identity theft, and any employment or tenancy background check will reveal this. In the US, identity theft has become a major industry.

Vast criminal networks perpetrate this crime, regrettably with great success. The Bureau of Justice Statistics (BSJ) [PDF] reported that just under 18 million people had suffered identity theft in 2014 at least once. The vast majority lost credit card, bank account, or other financial information.

2. Spot Scams and Spam

Not all phishing attempts are simple to detect. Scams via messaging, email, or on websites and social networks can appear quite legitimate. The easiest way to make sure your identity stays safe is by never clicking on any unverified links or opening emails or messages sent by someone you don’t know.

Sometimes, an email will look like it’s from your bank, but you need to look at the email address very closely even then. You might see an extra number or letter, which means the email has been spoofed. Never give out personal data to strangers who text, email, or call you even if their request seems legitimate. Banks and other official institutions typically don’t ask for it via these channels.

3. Use Strong Passwords

People tend to use the same or similar passwords on most sites, and that’s the dream of an identity thief. Once they crack the password, they can access all the platforms, on which you use it. This might include virtual banking, online brokers’ sites, and other financial sites you open now and then. From there, the thief can wreak havoc on your accounts.

As a rule of thumb, reliable passwords need to be more than 10 characters long and include a combination of symbols, numbers, and upper and lower case letters. Avoid using anything related to personal data, such as your mom’s maiden name, your grandfather’s middle name, and your date of birth or that of a relative or friend.

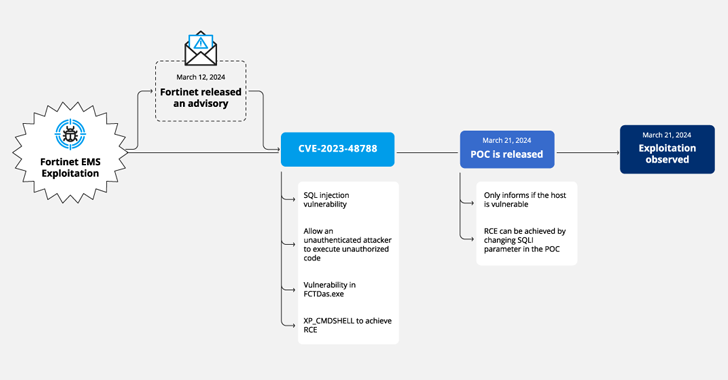

Using a password management tool is highly recommended, as is two-factor authentication (2FA), although that’s gradually being replaced by multi-factor authentication. This requires you to enter more than two credentials to access an account. For example, these might be a code sent to your phone, a password, and the answer to a security question. Multi-factor authentication minimizes the risk of data loss. More advanced forms of authentication can include a face, retina, or fingerprint scan.

4. Don’t Give out your Social Security number

Organizations like banks and the IRS need this information to identify you. So will your employer. They will never text, email, or call you asking for it. When an organization that’s different from those requests this information, exercise caution. For example, your child’s school, a company, or a medical office might not actually need it. If they ask for it, ask them what they need it for and if it’s mandatory to provide.

Also ask how they intend to protect it, whether there’s another identifier they could use, and if just the last four digits will serve their purposes.

5. Buy from Reputable Sites

Do your homework if you want to shop from a new company. Read user reviews, check to see if they use an encrypted and secure connection for financial and personal data, and check for a good Better Business Bureau (BBB) rating.

The website should start with HTTPS instead of HTTP. This stands for hypertext transfer protocol secure and was developed to ensure a site’s privacy and safety. To be extra safe, never enter personal or financial data at a site that starts with just HTTP.

Signs of Identity Theft to Look Out For

Apart from false data on credit reports, verify the name of your employer, your address, and your Social Security number. Missing bills are a red flag. Get in touch with your utility companies, bank, or credit card issuer if your bills don’t arrive or arrive late. Regular mail that’s gone missing may indicate that your account has been hijacked, and the criminal has rerouted your mail to a new address to cover up his tracks.

Banks and other sources of funding don’t typically alter their financing policies and terms dramatically all of a sudden. This means you should sit up and take notice if the interest rate on a product you use suddenly increases or you’re denied a loan or credit card for no obvious reason. Another relatively obvious sign is being approved for a credit card that you never applied for.

Don’t use public Wi-Fi unless you absolutely have to. If that’s the case, try to get a VPN (virtual private network). This tool can help you protect your personal information.

Final Thoughts

Taking the measures suggested here will help alert you to possible issues related to identity theft and reduce the risk of it happening to begin with. It will also help to look into security solutions that integrate identity theft protection because they can protect against viruses that steal data.